Charitable Giving - The effect of changes in tax law upon nonprofits

Charitable giving has become a big business in America!

Large organizations developed to support specific charities have generated large staffs to support the fundraising function and the marketing programs to attract contributions from the public. Federal and state tax law has been written to encourage contributions by offering deductions for charitable gifts from both personal and business income tax.

The Rise of For-Profit Fundraisers

This has encouraged the growth of large organizations that do nothing except raise funds for charities and which take significant portions of the money raised for management salaries and marketing expenses that amount in some instances to as much as 50% of the donated funds!

Recent changes to Federal Tax Law have reduced the attractiveness of the tax benefit of charitable giving, which has resulted in reductions in the amount of money given to charities. As a result, it has placed some strain on the budgets of some larger fundraising businesses.

The result is that charities are more dependent on gifts from persons and entities, less for the tax benefit and more because they just want to DO GOOD!

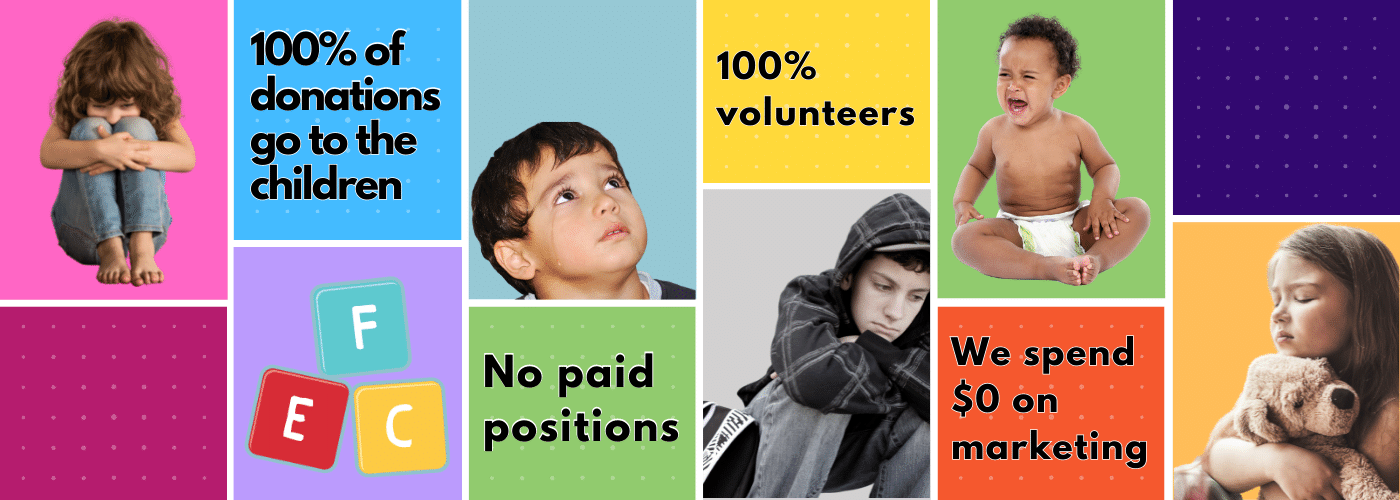

For Every Child which operates the Hope Totes program is committed to using all donated funds responsibly. The charity does not have paid positions, marketing budgets or use for-profit fundraisers. When you give $50 to For Every Child, 100% of that donation goes directly to helping the children in need.